Tether is and that is enough

Since its launch in 2014, Tether has maintained a juggernaut status that is, I think, significantly under-appreciated by a lot of (or maybe most) people in “crypto”.

A panoply of new stablecoin competitors have emerged over the last few years, most of which have stalled and or died off. A few have gained moderate traction, but for over half a decade, Tether has stayed untouchable.

This letter takes a quick look at data that show, despite on-going lawsuits, stolen funds, and relentless Twitter FUD, Tether is the king, and it’s not even close.

For starters, look at the market caps of other top stablecoin compared to Tether.

The lion’s share of Tether’s circulating supply currently lives on Ethereum. Tether launched as an ERC-20 token in September 2017, and the amount of Tether on Ethereum went essentially parabolic toward the end of Q1 2020.

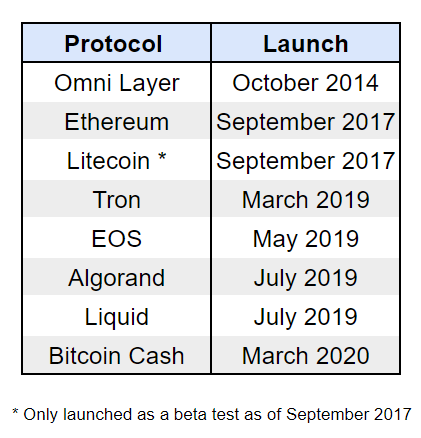

Ethereum’s share of Tether’s supply needs some context though. Since it launched as an ERC-20 token, the bellwether stablecoin has also officially launched on and or tested six separate protocols (also somewhat impressive). My guess is each of these protocols at best serve as hedges against potential Ethereum vulnerabilities or mainchain insufficiencies, and at worst they’re part of an on-going search by Tether for an Ethereum replacement.

Getting back to the data, what really surprised me while charting all of this (shoutout to CoinMetrics) is: Tether isn’t only the largest stablecoin in the entire industry; it’s also the second fastest-growing stablecoin! That’s wild.

For the past 12 months, prizes for the fastest growing stablecoin supplies belong to USDT and USDC. See the below column chart. That Tether takes second place is insane because the Tether market cap is 10 times larger than USDC’s, as seen in the first chart of this letter. That’s king shit.

Here’s the same data limited to year-to-date growth, which includes two new stablecoins (BUSD and HUSD).

I excluded BUSD and HUSD from my “official” ranking given their age (less than one year old) and use (less than 400 daily transactions each on April 1, 2020). All the same, Tether is seemingly unstoppable.

Compared to circulating supply and market cap (which, yes, I’m sort of using interchangeably even though the two metrics can diverge), transaction count is a superior measure of a digital asset’s dominance especially for stablecoins.

Unsurprisingly, Tether dominates this metric too. Here’s a chart.

The main idea behind this letter is: no matter how one configures the data, Tether has won nearly uncontested dominance in the stablecoin sector of “crypto”, and I think the odds of the status quo continuing are good. What’s more, Tether has accomplished this eminence by trailblazing a nascent sector in a wildly uncertain industry.

A “first mover” advantage doesn’t always materialize for new technologies especially in “crypto” (cf. cryptocurrencies that preceded Bitcoin). Tether, however, doesn’t give a fuck. Trading “crypto” is their industry. The rest of us are just playing in the metaphorical sand.

If you didn’t like this letter, you can yell at me on Twitter.

If you did like it, buy me a beer while I write the next one.

CashApp: @zackvoell

Bitcoin: 1Lo14crntGdhgTmLq1EsN51SmM26TTs7b3